Introduction to the NIKKEI 225 Index

The NIKKEI 225 Index stands as a symbol of Japan’s economic prowess and plays a crucial role in the global financial landscape. It represents the top 225 blue-chip companies listed on the Tokyo Stock Exchange (TSE). The index serves as a barometer for the overall performance of the Japanese stock market and is closely monitored by investors worldwide.

History of the NIKKEI 225 Index

The NIKKEI 225 Index was established in 1950, shortly after World War II, by the Nihon Keizai Shimbun (Nikkei) newspaper. Initially, it comprised just 176 companies, but it expanded over the years to include the current 225 components. The index has witnessed significant milestones, including the Japanese economic bubble of the late 1980s and the subsequent market crash.

Components of the NIKKEI 225 Index

The companies included in the NIKKEI 225 Index are selected based on strict criteria, including market capitalization, trading volume, and industry representation. The index covers various sectors such as automotive, technology, finance, and healthcare, providing a comprehensive snapshot of the Japanese economy.

Calculation Methodology

The NIKKEI 225 Index is a price-weighted index, meaning that companies with higher stock prices have a greater influence on its movements. The index is calculated using a simple average of the stock prices of its components, adjusted for stock splits and other corporate actions. Factors such as company earnings, economic indicators, and geopolitical events also impact its fluctuations.

Significance in the Global Market

The NIKKEI 225 Index holds significant influence not only in Japan but also in global financial markets. It serves as a key benchmark for Japanese equities and is closely watched by international investors seeking exposure to the Asian market. The index’s performance often reflects broader market sentiments and economic conditions, influencing investment decisions worldwide.

Performance Trends

In recent years, the NIKKEI 225 Index has experienced fluctuations influenced by various factors, including trade tensions, geopolitical risks, and domestic economic policies. Despite occasional downturns, the index has shown resilience and has rebounded from challenges, demonstrating the strength of Japan’s economy and corporate sector.

Impact of Economic Events

Economic events such as the global financial crisis of 2008 and the COVID-19 pandemic have had profound effects on the NIKKEI 225 Index. During periods of economic uncertainty, the index tends to experience heightened volatility as investors react to changing market conditions. However, it has also presented opportunities for long-term investors to capitalize on market dislocations.

Investment Opportunities

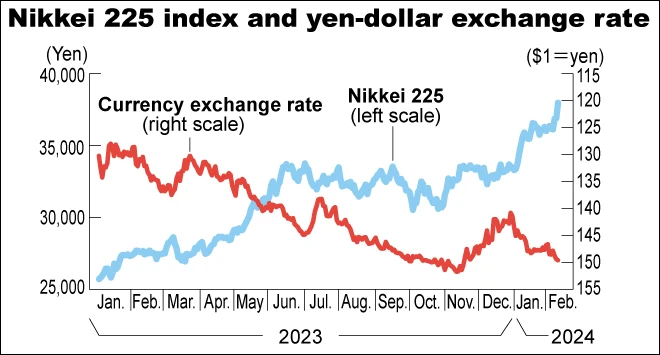

Investors often use the NIKKEI 225 Index as a benchmark for portfolio performance and as a basis for investment strategies. Exchange-traded funds (ETFs) and index funds tracking the index provide investors with diversified exposure to Japanese equities. However, investing in the NIKKEI 225 carries inherent risks, including market volatility and currency fluctuations.

NIKKEI 225 Index and Japanese Economy

The performance of the NIKKEI 225 Index is closely linked to Japan’s economic health, serving as an indicator of overall market sentiment and corporate profitability. Trends observed in the index can provide valuable insights into the trajectory of Japan’s economy, influencing policy decisions and business strategies.

Role of the NIKKEI 225 Index in Financial Analysis

Financial analysts utilize the NIKKEI 225 Index to assess market trends, conduct sectoral analysis, and evaluate the performance of individual companies. The index’s historical data and correlation with other market indices enable analysts to make informed investment recommendations and formulate investment strategies tailored to specific market conditions.

Challenges and Criticisms

Despite its significance, the NIKKEI 225 Index has faced criticism regarding its methodology and composition. Some argue that the index’s price-weighted calculation method can distort its representation of the overall market. Additionally, the exclusion of smaller companies from the index has drawn criticism for potentially overlooking emerging growth opportunities.

Future Outlook

The future of the NIKKEI 225 Index remains subject to various factors, including global economic trends, technological advancements, and regulatory changes. Continued efforts to enhance transparency and governance in Japan’s corporate sector may contribute to the index’s long-term stability and growth. However, uncertainties such as geopolitical tensions and demographic challenges pose potential risks to its performance.

Conclusion

In conclusion, the NIKKEI 225 Index plays a pivotal role in the Japanese and global financial markets, serving as a reliable indicator of market sentiment and economic performance. Despite challenges and criticisms, the index remains a valuable tool for investors, analysts, and policymakers seeking insights into Japan’s economy and corporate landscape.

FAQs (Frequently Asked Questions)

- What is the NIKKEI 225 Index?

- The NIKKEI 225 Index is a stock market index that represents the top 225 blue-chip companies listed on the Tokyo Stock Exchange in Japan.

- How is the NIKKEI 225 Index calculated?

- The NIKKEI 225 Index is calculated using a price-weighted methodology, where companies with higher stock prices have a greater impact on the index’s movements.

- What factors influence the performance of the NIKKEI 225 Index?

- Various factors, including economic indicators, corporate earnings, geopolitical events, and market sentiment, influence the performance of the NIKKEI 225 Index.

- Is investing in the NIKKEI 225 Index risky?

- Like any investment, investing in the NIKKEI 225 Index carries risks, including market volatility and currency fluctuations. It is essential for investors to conduct thorough research and consider their risk tolerance before investing.

- How does the NIKKEI 225 Index impact global markets?

- The NIKKEI 225 Index serves as a key benchmark for Japanese equities and influences global market sentiment. Its performance often reflects broader economic trends and can affect investment decisions worldwide.